California insurance crisis comes to Richmond’s Atchison Village

Richmond’s Atchison Village is facing an insurance availability crisis as major insurance companies continue withdrawing from California’s market or are declining to renew policies.

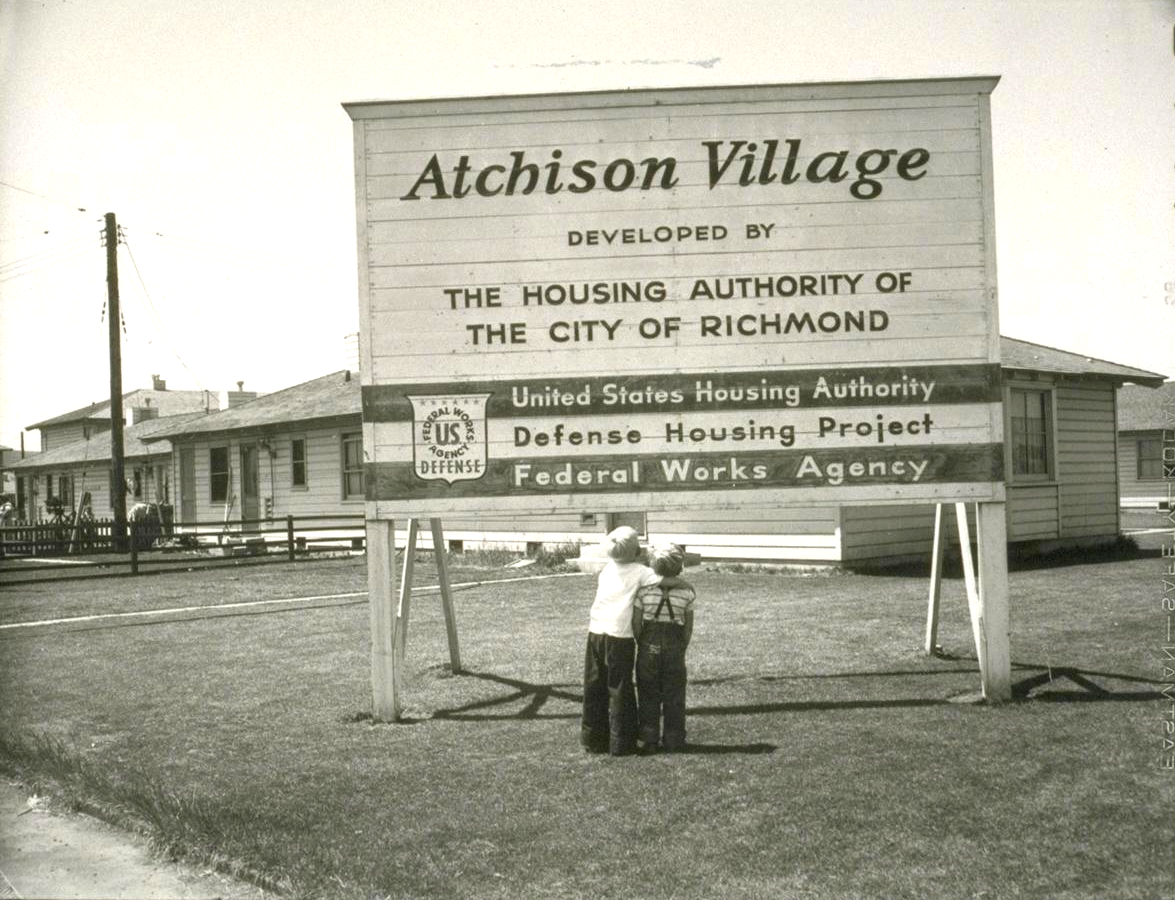

The 450-unit community, established in 1942 as government housing during World War II, now operates as a housing co-op. The unique ownership structure, location, and building age all complicate obtaining insurance.

The situation at Atchison Village is not unique. It reflects broader challenges in California’s insurance market, with insurance carriers facing significant losses since the 2017 wildfires and struggling to secure rate increases.

Madeline Marrow, a director on Atchison Village Mutual Homes Corporation Board, said their insurance broker has worked to find coverage but has warned their premiums may increase as much as four times their current rate of about $200,000 a year.

“Our community is composed of a lot of seniors and low-income families, and our reserve fund is not what it should be. We are very concerned about how we are going to pay these increased costs.” Marrow said.

“Most of the companies say we are too old. They don’t want to insure anything over 60 years. For a lot of these companies, we are considered commercial, and they don’t want to insure anything where people live,” Marrow said. “One company said we are too close to the refinery. One company said we were too close to the railroad tracks. Some say we have too much crime in the area because we are in the Iron Triangle.”

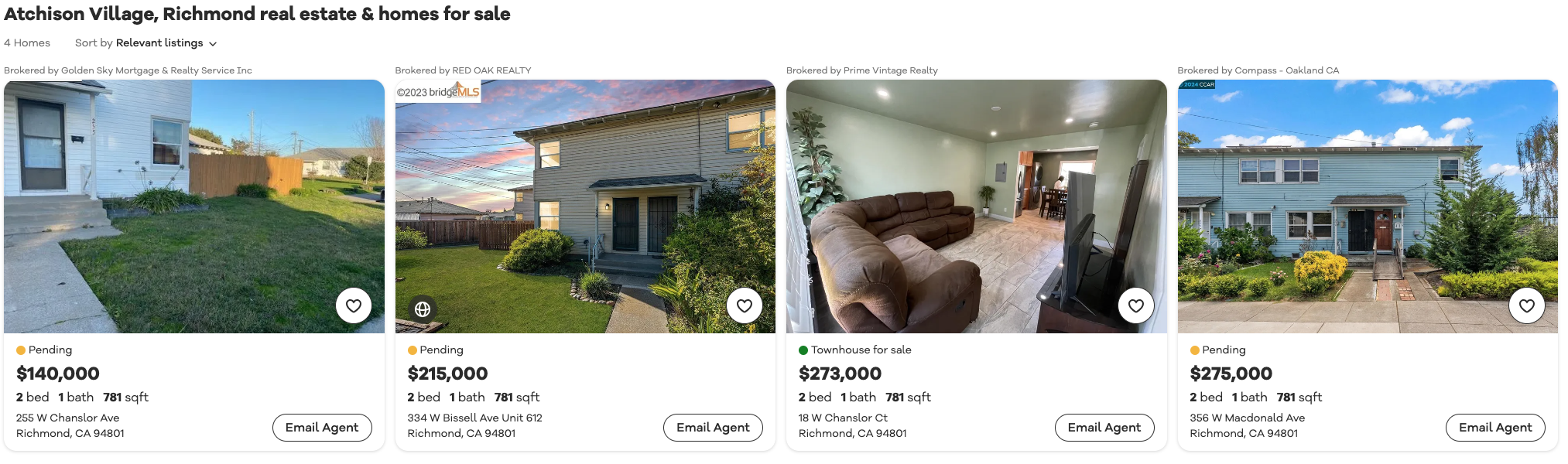

Atchison Village is different from a condo complex, Marrow explained. Residents do not possess deeds for their units. They own a share in the corporation, entitling them to live in their unit.

“You can’t get a regular mortgage because there is no deed. So you have to pay cash so that has kept the prices down here too. The average two-bedroom here, which is about 760 square feet, goes for about $200,000. Which is still pretty cheap, but you can’t get a mortgage,” Marrow said.

The government built thousands of units for the war effort but tore most of them down. Atchison Village’s units were slated to be torn down, and it was one of the last war housing communities still standing after the war.

“The people living here scraped together $50,000 in 1957. The government gave them a mortgage for $1.5 million. They paid it off in 20 years. That’s how it came to be,” Marrow said.

The corporation collects dues ranging from $330 to $360 monthly plus property taxes. The corporation is responsible for building roofs, siding, plumbing, electrical, water and sewage, garbage service, common areas, and fire and liability insurance.

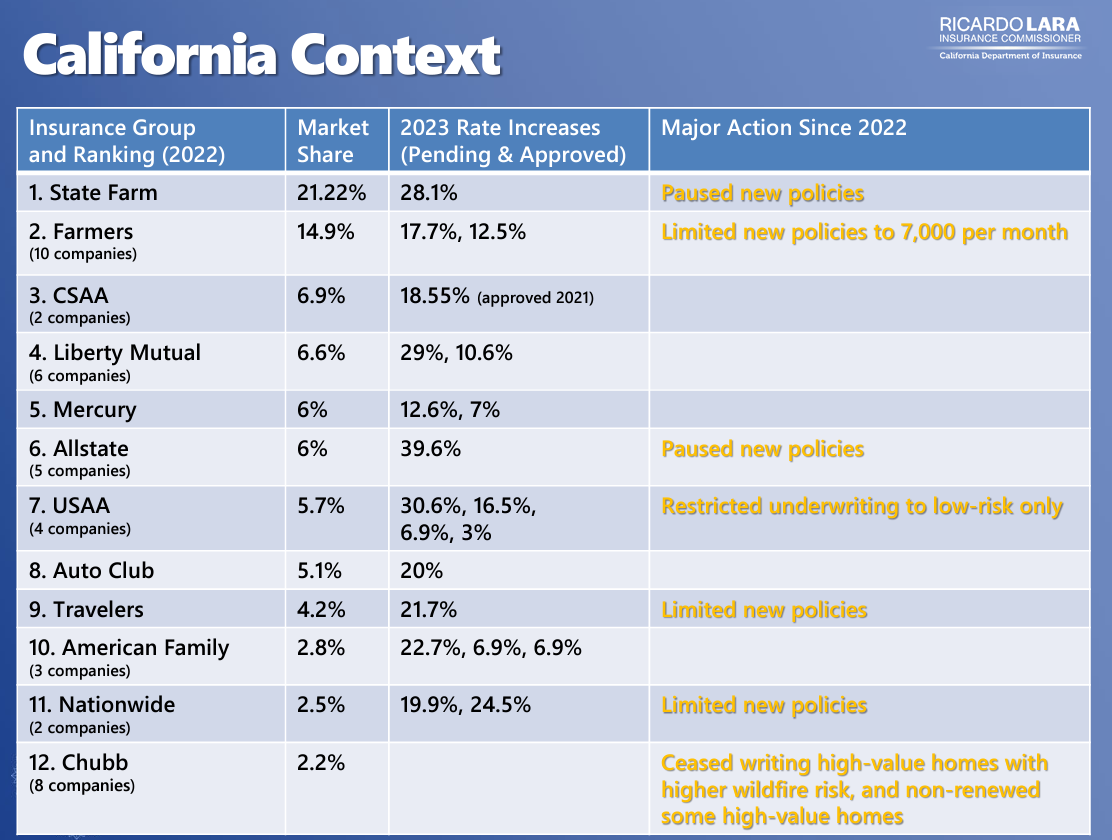

According to the California Department of Insurance, the property insurance market is changing quickly. Since 2022, seven of the top 12 insurance companies have paused or restricted new business in the state.

John Ziesenhenne, Chief Executive Officer at Richmond insurance broker M.A. Hays Co., said it is a dire situation for property owners across California, with some people going without insurance because it is not affordable.

Insurance carriers have been devastated by losses since the 2017 California wildfires and pretty much have not been able to get rate increases from Insurance Commissioner Ricardo Lara, Ziesenhenne said.

“The Insurance Commissioner is doing a terrible job in his position and taking way too long to approve rate increases,” Ziesenhenne said. “The insurance carriers are not operating on a profit, so they have pretty much pulled out of California or have just come to a standstill.”

Ziesenhenne said he received a memo last week stating the insurance commissioner will unveil a plan to deal with insurance availability issues in December of this year.

“What he needs to do is unveil a plan tomorrow at 5 o’clock because it is a desperate situation,” Ziesenhenne said. “He is not helping his constituency by having higher rates forced on them. For the most part, there are no for-profit companies writing policies in California.”

California Department of Insurance Press Secretary Gabriel Sanchez said Lara’s Sustainable Insurance Strategy will bring insurance companies back to wildfire-distressed areas and give Californians real options for insurance.

"He will be finalizing new regulations this year, and as a result, insurance companies have agreed to increase their writing across the state," Sanchez said.

California Proposition 103, enacted in 1988, requires insurance companies to seek advance approval from the California Department of Insurance before establishing property and casualty insurance rates. This system is said to be the most rigorous rate regulation framework in the nation.

Atchison Village will hold a town hall meeting for residents on Wednesday, Feb. 7, at 7:30 p.m., in their hall at 270 Curry St., to discuss these issues with their insurance broker and attorney.

Help keep our content free for all!

Click to become a Grandview Supporter here. Grandview is an independent, journalist-run publication exclusively covering Richmond, CA. Copyright © 2024 Grandview Independent, all rights reserved.